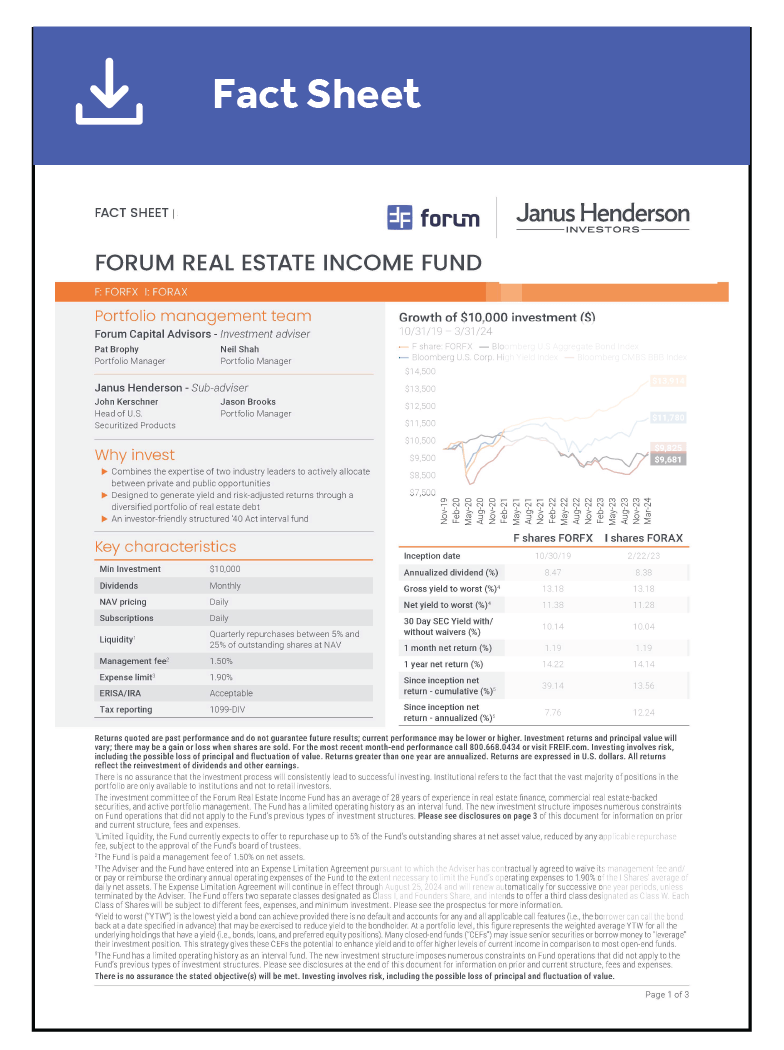

Targeting High Income with Low Volatility

Forum Real Estate Income Fund (“The Fund”) provides access to institutional real estate debt investments not typically available to individual investors.1

Forum + Janus Henderson:

A True Partnership

Forum Real Estate Income Fund benefits from two of the industry’s experienced investment advisers to source, evaluate, and monitor the Fund’s institutional real estate securities1.

Investment Adviser:

Forum is a private real estate investment manager focused on multifamily with an owner / operator mentality and experience in development, acquisitions, and lending.

Sub-Adviser:

Janus Henderson's mission is to help clients define and achieve superior financial outcomes through differentiated insights, disciplined investments, and world-class service.

Investment Objectives

The Fund’s primary objectives are to maximize current income and preserve investor capital, with a secondary focus on long-term capital appreciation.

01

MAXIMIZE

CURRENT INCOME

02

PRESERVE

INVESTOR CAPITAL

03

REALIZE LONG-TERM

CAPITAL APPRECIATION

Why Real Estate Debt?

We believe real estate debt may offer an attractive, relative value to investors in other real estate and fixed-income investments.

FLOATING RATE DEBT THAT OFFSETS DURATION RISK2

LOW CORRELATION TO THE BROADER MARKETS3

CREDIT RISK MITIGATION VIA

THOROUGH CREDIT AND

UNDERWRITING PROCESS

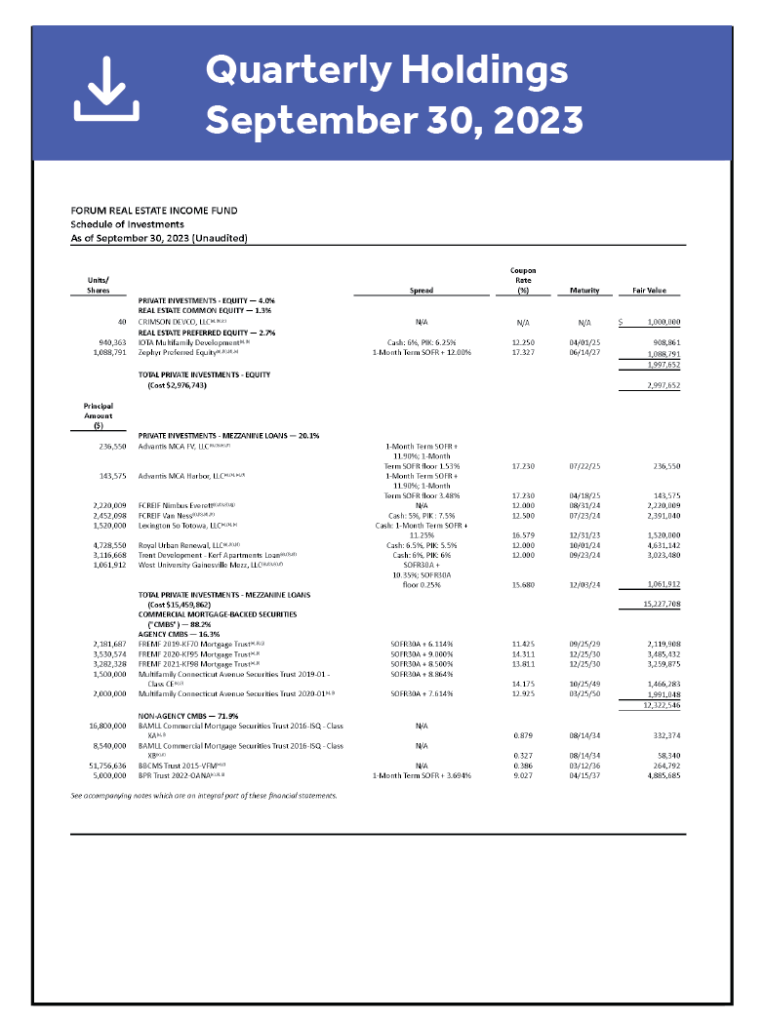

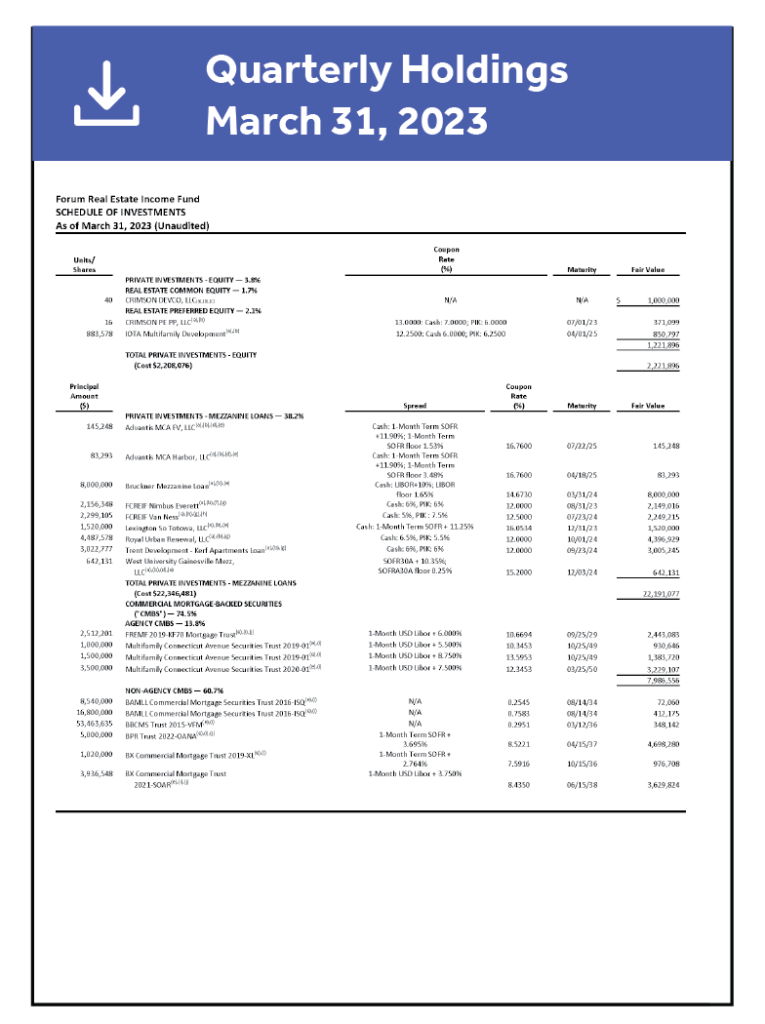

Portfolio Overview4

(AS OF MARCH 31, 2024)

Growth of a $10,000 Investment

(AS OF MARCH 31, 2024)

Past performance is not a guarantee of future results. The investment return and principal value of an investment in the Fund will fluctuate so that an investor's shares, when redeemed, may be worth more or less than their original cost. The returns shown do not reflect the deduction of taxes a shareholder would pay on Fund distributions or the redemption of Fund shares. Returns are calculated using the traded NAV as of the date of this table (above). The performance is based on average annual returns.

Fund Performance vs. Benchmarks

(AS OF MARCH 31, 2024)

FORFX Since Inception Net Return (Cumulative) is 39.14% and Since Inception Net Return (Annualized) is 7.76%.

Past performance is not a guarantee of future results. The performance data quoted represents past performance and current and future returns may vary. Total net return figures include change in share price, reinvestment of dividends and capital gains, net of fees and expenses. The investment return and principal value will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than the original cost. For the most recent performance, please call 888-267-1456 or email investorrelations@forumcapadvisors.com. Please refer to the important disclosures at the end of this presentation for a description of benchmarks. Dividends are not a direct reflection of fund performance. The Fund can pay dividends from any source, including income and realized gains. The Fund’s dividend proceeds may exceed its earnings, in which case portions of dividends that the Fund makes may be a return of money that Shareholders originally invested.

Simplicity of Access

DIRECT EXPOSURE TO INSTITUTIONAL REAL ESTATE DEBT SECURITIES1

BROAD INVESTOR

SUITABILITY

CUSIP / TICKER ACCESS

F Share: FORFX

I Share: FORAX

1940-ACT REGISTERED, CONTINUOUSLY OFFERED

CLOSED-END INTERVAL FUND

DAILY VALUATION, TARGET QUARTERLY TENDER OFFERS6

LOW INVESTMENT

MINIMUMS

1099 TAX

REPORTING

TAXED AS A REIT

*Forum’s executive leadership team has an average of 25 years of experience in real estate finance, structured finance, commercial real estate-backed securities, and active portfolio management.

1 Institutional refers to the fact that the vast majority of positions in the portfolio are only available to institutions and not to retail investors.

2 Duration risk is the potential loss that an investor faces due to changes in interest rates. It is a measure of the sensitivity of a bond's price to changes in interest rates, as it provides a measure of risk and potential loss. Source: Financestrategist.com.

3 The Fund has low correlation to fixed income and corporate credit benchmarks as measured by the Bloomberg USAgg index (Bloomberg ticker LBUSTRUU Index).

4 Allocations are subject to change and may include un-invested cash held by an underlying manager, committed to pending capital calls, or held as liquidity for upcoming distributions of the Fund.

5 Since Inception Net Return covers the period beginning October 2019 to March 2021 (the “Private Fund Period”) and the period beginning April 2021 to present (the “Registered Fund Period”) and is calculated based on formulas specified by SEC guidelines (Form N-1A) and AIMR Performance Presentation. For the Private Fund Period, the Adviser replicated periodic NAV based on historical fund information, as NAV was not a component of the Fund’s performance reporting during that time. Since Inception Net Return is shown on both a cumulative and annualized basis. The annualized Since Inception Net Return is the cumulative Since Inception Net Return divided by the number of years the Fund has been in existence, dating back to the commencement of the Private Fund Period. As of September 28, 2022, the Fund converted to a registered closed-end interval fund in accordance with Rule 23c-3 under the Investment Company Act of 1940, as amended (the “1940 Act”). The Fund commenced investment operations as a registered closed end tender fund on April 16, 2021, after the conversion from a limited partnership private fund exempt from registration under the 1940 Act, Forum Integrated Income Fund I, L.P., which commenced operations on October 24, 2019, (the “Private Fund”). Information portrayed prior to April 16, 2021, reflects the Private Fund. The Private Fund was not registered under the 1940 Act, and therefore was not subject to certain restrictions imposed by the 1940 Act on registered investment companies and by the Internal Revenue Code of 1986 on regulated investment companies. If the Private Fund had been registered under the 1940 Act, the Private Fund’s performance may have been adversely affected. Furthermore, the fees and expenses of the Private Fund were substantially different from the Fund’s fees and expenses. The fees and expenses of the Fund in the tender fund structure differ from the fees and expenses of the interval fund structure.

6 Limited liquidity, the Fund currently expects to offer to repurchase up to 5% of the Fund’s outstanding shares at net asset value, reduced by any applicable repurchase fee, subject to the approval of the Fund’s board of trustees.

Investors should carefully consider the Fund’s investment objectives, risks, charges, and expenses before investing. This information is included in the Fund Prospectus and may be reviewed through the Prospectus link above. Please read the prospectus carefully. An investment in the Fund is subject to, among others, the following risks.

- Past performance is not guarantee of future returns. There can be no assurance that the Fund will achieve its investment objective.

- Investing involves a high degree of risk. Principal loss is possible.

- Forum Real Estate Income Fund is a diversified, closed-end management investment company that continuously offers its shares of common stock (the “Shares”), and is operated as an “interval fund.”

- There is currently no secondary market for its shares and the Fund does not expect any secondary market to develop for its shares. Accordingly, you may not be able to sell shares when and/or in the amount that you desire. Investors should consider shares of the Fund to be an illiquid investment.

IMPORTANT INFORMATION

The materials are intended for informational purposes only and are subject to change. This is not provided as investment advice or a recommendation to you. Such an offer to sell or solicitation to buy an interest in the Fund may be made only by the delivery of the Fund’s prospectus. In the event that these materials and the prospectus are in conflict, the prospectus terms shall control. Please review the prospectus fully and consult with your legal, financial, and tax counsel, as appropriate. Any product or service referred to herein may not be suitable for all persons.

Past performance is no guarantee of future returns. The Fund’s performance can be volatile, and the investment involves a high degree of risk.

Investors should consider the investment objectives, risks, charges, and expenses carefully before investing. Investors should read the prospectus and summary of additional information carefully with this and other information about the Fund. For additional information, please call 888-267-1456 or email InvestorRelations@forumcapadvisors.com.

Investing in the Fund involves risks, including the risk that an investor may receive little or no return on his, her or its investment or that an investor may lose part or all of such investment. Therefore, investors should consider carefully the following principal risks before investing in the Fund. There is no assurance that the Fund will achieve its performance or investment objectives or achieve any target distribution yield. Shareholders may lose some or all of their invested capital, and prospective investors should not purchase the Fund’s shares unless they can readily bear the consequence of such loss. Limited liquidity is provided to shareholders only through the Fund’s quarterly repurchase offers. There is no guarantee that shareholders will be able to sell all of the shares they desire in a quarterly repurchase offer. The Fund’s investments are also subject to liquidity risk. Funds with principal investment strategies that involve securities with substantial credit risk tend to have a relatively higher exposure to liquidity risk.

As a non-diversified investment company, the Fund may invest more than 5% of its total assets in the securities of one or more issuers. The Fund may therefore be more susceptible than a diversified fund to being adversely affected by events impacting a single borrower, geographic location, security, or investment type. The Fund’s investments in real estate debt are expected to be secured by commercial real estate assets. The Fund’s concentration in the real estate sector may increase the volatility of the Fund’s returns and may also expose the Fund to the risk of economic downturns in this sector to a greater extent than if its portfolio also included investments in other sectors. Further, there is no limit regarding the amount of Fund assets that may be invested in any single geographic area within the United States. To the extent the Fund concentrates its investments in a limited number of assets or geographic areas, the Fund will be subject to certain risks relating to concentrated investments.

Commercial real estate debt instruments (e.g., mortgages, mezzanine loans and preferred equity) that are secured by commercial property are subject to risks of delinquency and foreclosure and risks of loss that are greater than similar risks associated with loans made on the security of single-family residential properties. The Fund expects to invest a portion of its assets in pools or tranches of commercial mortgage-backed securities (CMBS)*. In a rising interest rate environment, the value of CMBS may be adversely affected when payments on underlying mortgages do not occur as anticipated, resulting in the extension of the security’s effective maturity and the related increase in interest rate sensitivity of a longer-term instrument. Subordinate CMBS are also subject to greater credit risk than those CMBS that are more highly rated. Mortgage loans on commercial properties generally lack standardized terms, which may complicate their structure and increase due diligence costs. Commercial mortgage loans also tend to have shorter maturities than single-family residential mortgage loans and are generally not fully amortizing, which means that they have a significant principal balance or “balloon” payment due on maturity.

Certain transactions the fund utilize may give rise to a form of leverage through either (a) additional market exposure or (b) borrowing capital in an attempt to increase investment return. The use of such transactions includes certain leverage-related risks, including potential for higher volatility, greater decline of the fund’s net asset value and fluctuations of dividends and distributions paid by the fund.

DEFINITIONS and DESCRIPTIONS OF BENCHMARKS

CMBS IG BBB: is represented by the Bloomberg Barclays CMBS Investment Grade BBB Total Return Index. The index measures the market of conduit and fusion CMBS deals. AGGREGATE BOND: Represented by the Bloomberg Barclays US Aggregate Bond Indexwhich is a broad-based measure of the global investment grade fixed-rate debt markets. HIGH YIELD: is represented by the Bloomberg Barclays US Corporate High Yield Total Return Index which measures the USD-denominated, high yield, fixed-rate corporate bondmarket. S&P 500: is a benchmark of large-cap US equities. FTSE NAREIT All Equity REITS: Index is a free float adjusted market capitalization weighted index that includes all tax qualified REITs listed in the NYSE, AMEX, and NASDAQ National Market. REIT Preferreds:preferred shares of listed REITs that typically have a stated coupon, no maturity date, no voting rights, and are senior to common equity in the underlying listed REIT.

Distributor: Foreside Fund Services, LLC

A security backed by commercial and multifamily mortgages rather than residential real estate.